How to Determine a qualifying Proportion to have a mortgage

A credit history out of 550 informs finance companies you are a top-chance borrower, however it does not at all times bring you untouchable. The new Government Houses Administration and also the You.S. Agencies out-of Agriculture straight back fund to have possible residents with lower than glamorous score, such 550, if they see the requirements. Mainly because applications safety losses when the a debtor non-payments, loan providers are more happy to accept borrowers exactly who if not couldn’t be eligible for financing.

You happen to be eligible for a keen FHA and you can/otherwise USDA home mortgage loan, whether or not your credit rating is 550, by applying for mortgage loans below these two programs.

Look for FHA Loan providers

Discover a loan provider close by accepted getting FHA finance. Visit the You.S. Homes and you will Urban Innovation Lender List page on the internet site. Enter the area and you may state otherwise postcode and click Search locate a listing of recognized loan providers and make contact with recommendations. Ask the financial institution regarding the its borrowing criteria, since specific lenders will get refuse the job whether your credit rating was 550.

Influence The FHA Loan Limit

FHA loan constraints are different, with regards to the city for which you propose to purchase your household. Visit the look web page to possess FHA Home loan Restrictions, and use the fresh new pull-off menu to choose the condition. Enter the state in which you want to buy your domestic. Click Publish. The second page that comes right up will teach the newest limitations offered to possess FHA insured financing, in line with the sort of property – single-family members to four-loved ones hold.

Profile Your own Forecast Payment

In order to qualify for an enthusiastic FHA loan, your housing-expense-to-earnings proportion cannot surpass 31 % of one’s monthly revenues as well as your a lot of time-term-debt-to-money ration do not go beyond 43% of monthly gross income. The first proportion simply requires under consideration brand new month-to-month homeloan payment. The second proportion includes this new month-to-month homeloan payment along with auto, mastercard or any other financial obligation payments.

Determine just how much house and you may monthly payment you can afford that have a property Cost Calculator, like the one out-of Agent. Enter the needed advice, as well as your yearly otherwise month-to-month ahead of-income tax income and projected financial interest rate, upcoming mouse click „Assess.“

Supply the Down payment

Because your credit history try 550, FHA cannot guarantee that loan of greater than ninety per cent of your house’s price. Build a downpayment equivalent to ten percent of your own worth, otherwise rates, of the property you may have receive buying.

USDA Protected Funds

Take care of a prompt percentage background in the 12 months ahead of when you desired trying to get an effective USDA guaranteed financing; while making later costs and having the judgments or membership referred to a collection agencies or agency usually disqualify your. You additionally usually do not has actually a property foreclosure otherwise released case of bankruptcy on your own records inside the prior three-years. Pay off their taxes or other expense with the authorities.

Seeking an excellent USDA Home

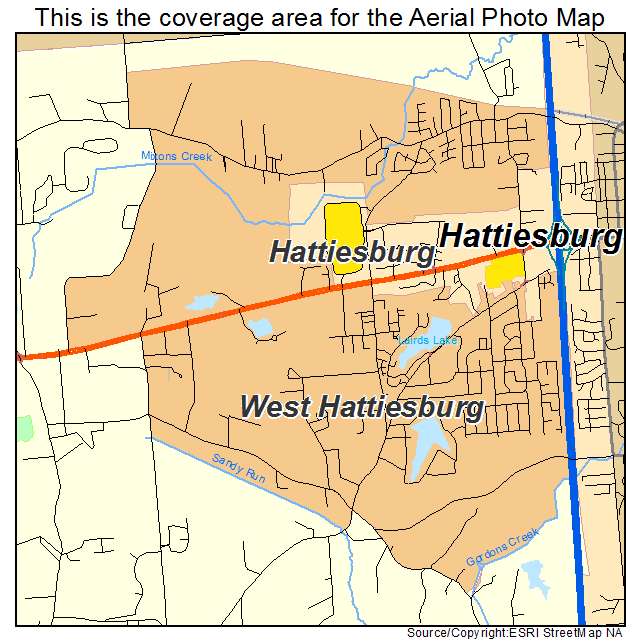

Check out the U.S. Institution regarding Farming Money and you may Assets Qualification Web site to acquire good family inside the a location you to definitely qualifies because the outlying. Click the Single Family relations Casing hook up around Assets Qualifications. Go into the target of the home you should get. You may want to pull and zoom the fresh new chart for the need condition and urban area otherwise neighborhood; brownish shaded section shady portray locations where dont qualify for an outlying Invention loan.

Determine Your USDA Home Qualifications

Verify that youre money-qualified by the first opting for Solitary Family relations Property around Income Eligibility to your the property Eligibility Site. Get the state the spot where the house is discovered from the pull-down menu and you may proceed with the prompts towards succeeding profiles to enter the state, household guidance, expenditures and you can monthly revenues. Mouse click Become. Another page will tell you regardless if you are eligible or ineligible into Section 502 Secured Rural Housing Financing.

Estimate Your USDA Costs

So you can be eligible for good USDA loan, the mortgage repayment you should never exceed 29 % of your monthly gross income plus financial, auto, credit card or other personal debt payments dont meet or exceed 41 % regarding your own monthly gross income. You are not required to create a downpayment however, performing so is all the way down these types of rates because you might be applying for a smaller sized mortgage.

Shape what valued household and you will mortgage repayment you really can afford using Realtor’s Family Value Calculator. Go into the expected pointers, as well as your annual or monthly just before-tax income and projected mortgage interest rate, next simply click „Calculate.“

Pull a free credit report away from AnnualCreditReport. Look for people mistakes, such as membership you never has otherwise never launched, or a fantastic accounts you may have satisfied. Conflict the fresh errors written down on credit reporting agency.

Ask your lender to perform https://paydayloanalabama.com/sulligent/ a-sudden Rescore if you feel your rating become highest, such as for instance that have paid back a good number of loans, and you also want to avoid looking forward to the credit agency in order to processes all the info. The financial institution will most likely charge you a fee for this particular service.

When you have troubles conference the debt-to-income rates, decrease your credit card or other financing balance by paying more than minimal repayments and never trying out the financial obligation. An alternative choice locate a less costly home or boost the advance payment.

- : HUD 4155.1: Section 4, Part A good – Borrower Eligibility Standards

- : FHA Mortgage Limits

- : FHA Lenders

- : HUD 4155.1: Section 4, Area F – Borrower Qualifying Percentages

- The newest Construction Assistance Council: USDA Secured Outlying Construction Finance (Section 502)

- Federal Relationship off Areas: City-Condition Research

- What’s a sudden Rescore? | Using into the 2020, Information & The way it works

- U.S. Agency of Farming: Unmarried Family relations Construction Guaranteed Loan Program

- Realtor: Home Affordability Calculator

Christopher Raines possess discussing their expertise in team, monetary things while the rules. The guy acquired his organization government and you may legislation degrees from the College or university of North carolina during the Church Hill. Since the a lawyer due to the fact August 1996, Raines possess managed cases associated with providers, consumer or any other aspects of what the law states.