In the present fast-moving business, the idea of a traditional 9-to-5 efforts are evolving easily. Of numerous Australians is investigating solution ways of earning earnings, like freelancing, part-go out functions, otherwise concert economy work.

When you’re this type of low-antique performs plans render flexibility, they may be able together with improve questions relating to eligibility having funds. Whenever you are in times for which you don’t have an entire-time business but you prefer financial assistance, you will be curious if or not you could potentially nonetheless get that loan in australia.

Do not get Perplexed from the Financing: Understanding the A variety and you may What they Imply

Prior to diving to your application for the loan processes, it’s essential to comprehend the all types of loans found in Australia. For each and every mortgage equipment is sold with its own gang of qualification requirements and needs. Some common particular funds become:

- Signature loans: Personal loans are typically unsecured and can be studied a variety of objectives, including debt consolidation, renovations, or scientific expenses.

- Auto loans: If you are looking to find an loans Pine Valley automible, you could potentially sign up for an auto loan, hence uses the car since the guarantee.

- Home loans: Mortgage brokers are used to buy or refinance a residential property. These types of finance always require a far more stable income source.

- Small business Finance: Entrepreneurs and you will small business owners can apply to possess loans so you’re able to fund the options.

Ideas on how to Browse Loan requests having Low-Old-fashioned Money otherwise Help Records to possess Loan applications with Low-Antique Money

If you don’t have an entire-go out employment but earn income regarding non-conventional present eg freelancing, consulting, or region-date really works, you may still qualify for certain kinds of loans. Lenders are getting more versatile inside their financing standards and may also think about your money from the offer.

- Proof money: Lender statements, statements, otherwise tax statements may help have shown your own earning capability.

- A steady performs record: When you have a reputation consistent money off freelancing otherwise part-day performs, it does boost your application for the loan. Generally speaking, asset money loan providers pick about 6 months of continued part-day operate in a similar business.

- A powerful credit history: Good credit normally make up for a lack of complete-go out a career.

- Guarantee or Guarantors

In the event your money was irregular otherwise you might be unable to satisfy antique money requirements, you’ll be able to consider delivering equity or which have good guarantor co-sign your loan. Equity can be a secured asset such as for instance a vehicle or property, when you are a beneficial guarantor are an individual who believes to take obligation to the financing if you’re unable to build costs. This type of choices can increase your odds of loan recognition.

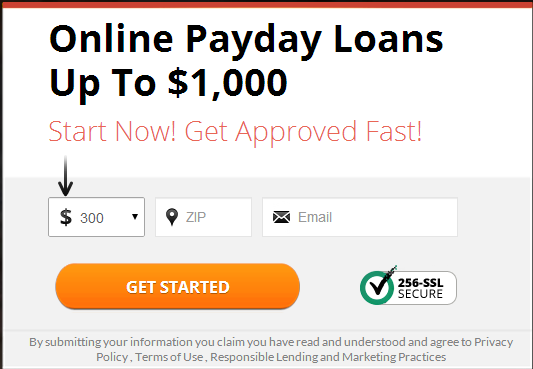

Mention Solution Lenders: Conventional banks could have more strict financing requirements, so it is difficult to score a loan without a full-date employment. Yet not, solution lenders, like online loan providers otherwise peer-to-peer financing programs, usually have more versatile qualifications standards. Definitely look these choices and you can examine interest rates and you may conditions before applying.

Alter your Credit history: An effective credit score should be an important facet obtaining accepted for a financial loan, specifically if you possess unpredictable money. Take the appropriate steps to evolve the borrowing from the bank if you are paying bills promptly, cutting a fantastic expense, and you may disputing one errors on your own credit file.

Would a very good Monetary Plan: When making an application for financing instead the full-go out business, it’s important to demonstrate to loan providers that you could manage your profit sensibly. Create a funds, reveal that you could security mortgage payments, and you can definition how the financing is utilized for a productive mission.

While not that have a full-big date job may establish demands when trying to get a loan, it does not necessarily give you ineligible. It is important to research your options, envision alternative lenders, and stay ready to offer files you to definitely reveals your capability to pay the mortgage. At exactly the same time, maintaining a good credit score and having equity otherwise a good guarantor can increase your chances of a loan recognition. Eventually, your financial balances and creditworthiness will play a serious role into the deciding your own qualifications for a loan, aside from the a career standing.