step one. Structure Funds are very different in order to conventional lenders

Design financing are created to permit you the capability to generate your ideal household, also so you can decrease dangers of investment blow-away and you may waits. Most of the financial possess different regulations but fundamentally never expect to get the entire sum after you signal all the papers. The borrowed funds is sometimes disbursed inside a serious away from repayments named improvements costs otherwise drawdowns. Talking about proportions of the currency you will acquire, also it form you are going to found a lot of bucks every time you initiate another stage on your investment.

- Slab Pouring the slab

- Frame Improving the frame with the roof over the top

- Lock-up Locking-up the layer of the house

- Utilities- establishing progressive organization

- Latest incorporating latest joins and you can review to have achievement.

2. A meticulous techniques should be adopted to gain access to the money

Registered designers must pay statements and you can an overview of the pastime on loan providers. While you are a proprietor builder, you might also need to transmit receipts and you will statements before requesting the fresh new second drawdown. A bank assessor will likely then assess the building at each phase from drawdown to make certain that for every stage is done, and you can everything you complies through its individual financing and you will courtroom conditions. The lending company commonly intend to point new fee just adopting the auditor’s acceptance.

step three. It seems sensible getting a boundary to possess unforeseen expenses

Loan providers usually examine your serviceability of your mortgage and will not get better your hardly any money unless he has with full confidence examined what you can do to settle. It’s always best to do so caution towards the loan amount and you may do not push it on restrict. Always attempt to has actually a shield right from the start. You might have to believe https://paydayloanalabama.com/lookout-mountain/ in so it to have unexpected expenses.

When your endeavor can cost you strike aside, you should speak to your agent instantaneously. They’re able to provide good advice and have your the options. Several times, a lender need a fair solution. However, in the event that a bank says no so you can addiotnal borrowing from the bank (lending), the excess-will set you back out-of conclusion have a tendency to fall you.

4. Construction financing need particular files

In virtually any domestic construction financing, the lending company will assess the property value your own homes, and check the newest calculate will set you back associated with materials, work, and you will workmanship.

a copy of basic bargain towards licensed workers otherwise their percentage schedule in case you are a creator manager

Loan providers would also like to ensure that you can afford the construction financing, so they require specifics of your own annual money, credit history, and you can assets you possess. You should assistance your comments which have appropriate documentary research.

5. House Design Loans provide loads of positives

the chance to individual yet another dwelling, in which you require and how you need it, without having to waiting years if you don’t years to save up the bucks

assurance that designers will perform their job – new contractors and the designers was paid down with respect to the improvements of its work; whenever they promote careless characteristics, the lender will get avoid fee until sufficient developments will likely be revealed

most useful handling of expenses-when you yourself have a ton of money for your use at the one big date, you might end up being tempted to to get prohibitively expensive activities; drawdowns end really borrowers getting irresponsible that have huge amounts of money

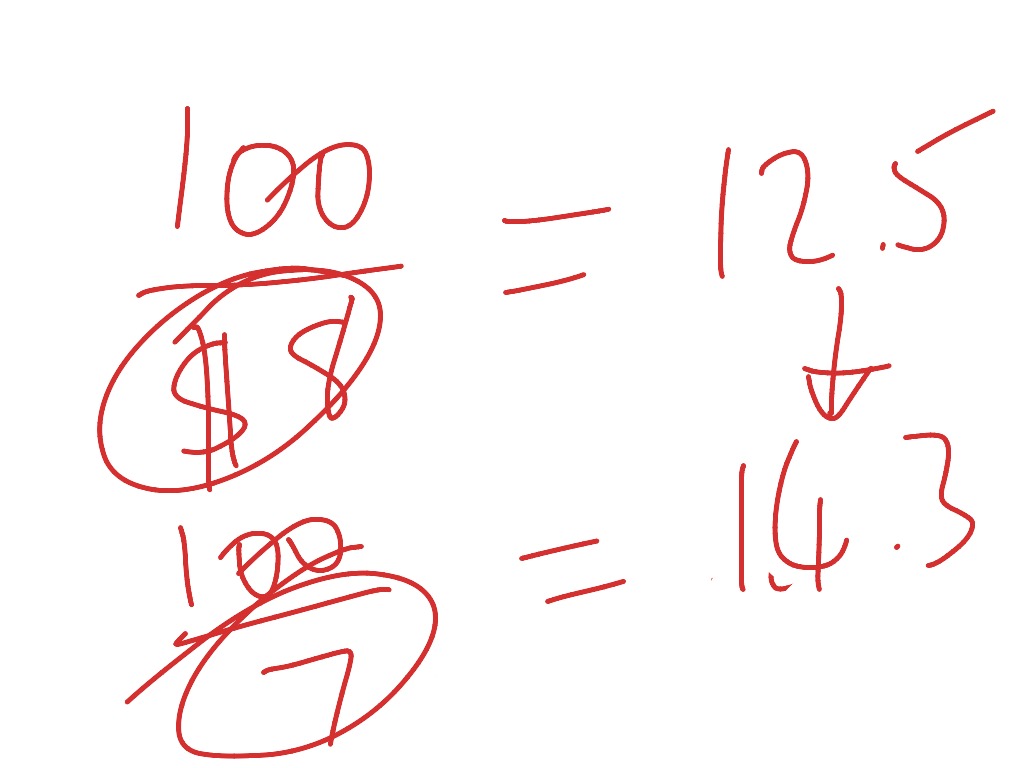

economising options- Framework funds are often attention merely money till the design try done and you are only energized attract into full count getting handed at any provided phase of venture. This will help to that have cashflow throughout an occasion where in actuality the assets try unlivable, or you can’t get any book for this.

six. There are even two cons to consider

You desire a high deposit-that it is applicable primarily to help you owner builder money that are noticed a great riskier; you are wanted a lower-percentage in excess of twenty-five%

The level of documents called for along side amount of the project everything you in the above list, together with floor arrangements and bluish guide, hence comprises info for instance the question used in external insulation.

the dangers off ascending interest levels- really structure loans are carried out towards the variable costs Idea and you will Notice. When your hidden cost rise, this might apply at your ability to meet up with payments. It’s been for example associated during the last eighteen months during the Australia in which financial support pricing enjoys grown from the more than step 1.25%. following the end of recovery/ structure really works, the mortgage reverts to help you a fundamental mortgage.

It is best to find expert advice when you decide to take such as for instance an important action. Design finance are going to be problematic and needs the help of a keen specialist. For further details about build loans or restoration financing, don’t hesitate to phone call or email me personally privately at the [current email address protected]