- Mutual equity programs: Of these using Society Property Trusts otherwise the same as score on to the latest homeownership steps

- RefiNow: Stretched qualification conditions for down-money residents

- Large LTV Refinance: You might be able to refinance your current Federal national mortgage association mortgage, even although you have limited family guarantee (meaning your own financial harmony is practically their home’s worthy of)

Freddie Mac computer loan apps

But it phone calls them of the some other brands. Such, Domestic You’ll be able to is actually the type of HomeReady. And you can CHOICERenovation is exactly what they phone calls Homestyle.

Mainly, you will be pushed to share how do i do a cash advance with Freddie and you can Fannie’s circumstances aside. Very work on the loan administrator to pick that is best for your requirements.

Conforming loan limits

Fannie and you can Freddie is both managed because of the Federal Casing Financing Institution (FHFA), for this reason its loan items are thus equivalent. And you will, each November, new FHA condition their loan limitations for the next seasons.

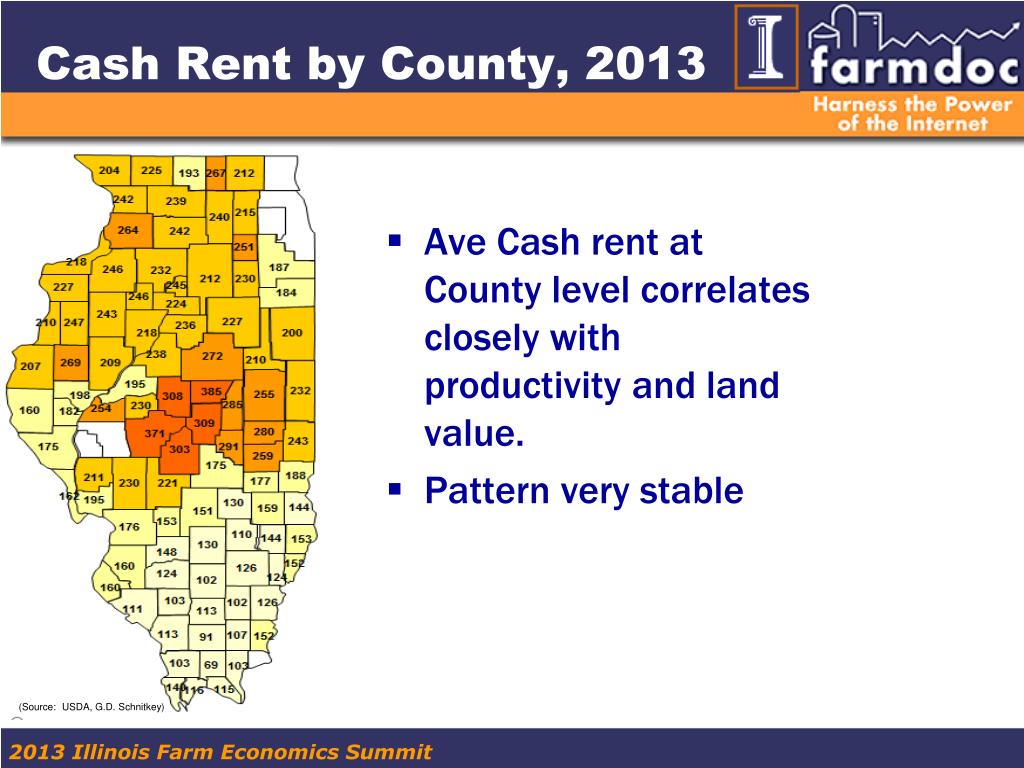

This type of constraints lay the absolute most you could potentially use having fun with a beneficial conforming loan. Very unmarried-household members house on U.S. was protected by the quality loan limitation, which is $ when you look at the 2024.

Although not, if you are to purchase a home within the a place having significantly more than-average home values, you are capable obtain so much more: Things ranging from $ and you may $ , depending on how higher home values are located in your neighborhood.

Conforming mortgage limitations to have 2024

Discover the latest restrict you to definitely applies in which you need certainly to get using an entertaining chart to the FHFA’s web site. If you want to obtain more, you can move to an effective jumbo mortgage.

Conforming mortgage prices and you may PMI

Conforming financing are considered lower-risk compliment of their backing regarding Fannie and you can Freddie. This means lenders can also be normally provide lowest pricing in these mortgages.

But not, remember that compliant mortgage pricing are greatly dependent on your private finances; specifically, on your credit rating and you will downpayment. The higher their rating therefore the large your down payment, the lower your rate of interest could well be.

One more thing to mention is that old-fashioned fund with below 20% off need individual mortgage insurance rates (PMI). That it even more fee every month assists manage loan providers once the reasonable-down-commission loans are believed riskier. On the bright side, conforming loan PMI can be removed afterwards, whereas FHA financial insurance is often permanent.

Compliant loan pricing are the essential aggressive in the market, apart from Virtual assistant loan costs. But once this is written, financial pricing was basically really unpredictable. And you can, when segments are disturbed, relative costs around the additional mortgage types is temporarily fall-out away from positioning.

Very check financial prices now and you may contrast all of them round the some other loan items. Shell out as much focus on the fresh apr (APR) once the intense mortgage price. APRs is most useful tell you the real price of one loan just like the it reason for financing costs.

Compliant loan FAQ

A compliant financing is a type of antique mortgage. All conforming fund try antique, meaning they’re not supported by government entities. But not most of the old-fashioned loans is compliant, because conforming funds need fulfill financing criteria lay from the Fannie mae, Freddie Mac, as well as the FHFA.

A conforming loan match assistance put from the Fannie mae and you may Freddie Mac computer, when you are a non-conforming financing fundamentally doesn’t. Non-conforming funds may help borrowers having large financing wide variety, lower borrowing, or low-old-fashioned earnings who’re beyond your compliant loan direction. Yet not, non-conforming loan rates are usually more than conforming mortgage cost.

You’ll be able to find out if you have a conforming loan using the loan lookup products towards the Fannie mae and you may Freddie Mac’s websites. You will need to supply your title, street address, as well as the past four digits of the social defense amount. Definitely check out both these sites, just like the sometimes service you’ll own the financial.