Within Bills, we try to build monetary conclusion confidently. Even though many of your own issues assessed are from our Providers, plus people with and therefore the audience is associated and people who make up you, the evaluations will never be influenced by him or her.

According to Capital One’s web site, the bank have discontinued their household-mortgage business. Not only does Financial support You to don’t undertake new apps, it is extremely not upkeep earlier in the day financing.

However, Money That does offer potential choices for individuals seeking to obtain currency. It has a recommendation plan having Loan Depot, which offers refinancing fund. A finances-out refinance loan shall be a substitute for a property security financing.

As an alternative to a beneficial HELOC, a knowledgeable possibilities one to Financial support One even offers are credit cards. The newest areas below will explain just how this type of almost every other borrowing tactics might work as options to help you property guarantee loan otherwise a good HELOC in addition to cons.

Referral in order to Mortgage Depot family equity mortgage

Regardless of if Funding You have deserted their home-lending company, it can has an advice experience of Financing Depot. You to relationships now offers customers who’re labeled Loan Depot as a consequence of Funding An individual’s web site up to $step one,five-hundred in financial credit after they sign up for a loan that have Loan Depot.

People lender credit is applicable to closing costs, that don’t include focus-price dismiss items. The amount of lender borrowing certain debtor gets might be the new minimal from $step 1,500 and/or full closing costs.

And the recommendation benefit getting consumers arriving at Loan Depot compliment of Funding One to, Financing Depot now offers big resources. It is the country’s fifth-premier merchandising bank. Loan Depot possess funded over $275 million during the finance, and helps more than 27,one hundred thousand customers every month.

Mortgage Depot’s offerings become re-finance funds. installment loans no credit check Memphis Significantly less than specific facts, a profit-away refinance mortgage can be used as an option to good household guarantee financing. Taking out a funds-away refinance could make experience should you get straight down rates (and additionally charges) than your existing home loan.

Regrettably, Loan Depot even offers absolutely nothing factual statements about the fresh specifics of its finance, until it is offered information regarding a possible borrower’s assets and you will financial predicament. not, Mortgage Depot has a group of subscribed financing officials whom can be book prospective individuals from the bank’s financing solutions and you will software processes.

Financial support You to credit card

While you are charge card interest rates are generally more than HELOC cost, a borrower which requires borrowing to possess a comparatively short-period get discover credit cards which have an effective 0% introductory rate as a more prices-effective option. Financial support That also offers about three credit cards that might be glamorous inside that situation:

- VentureOne Perks Cards

- Quicksilver Advantages Card

- SavorOne Perks Card

- Basic interest rate: 0%

- Length of introductory interest months: 15 months

- Interest variety after basic period: % so you’re able to %

- Harmony import fee: 3%

- Credit-score demands: excellent borrowing

- As well as its borrowing from the bank words, this type of about three cards every render benefits that could be accustomed reduce your price of using borrowing from the bank

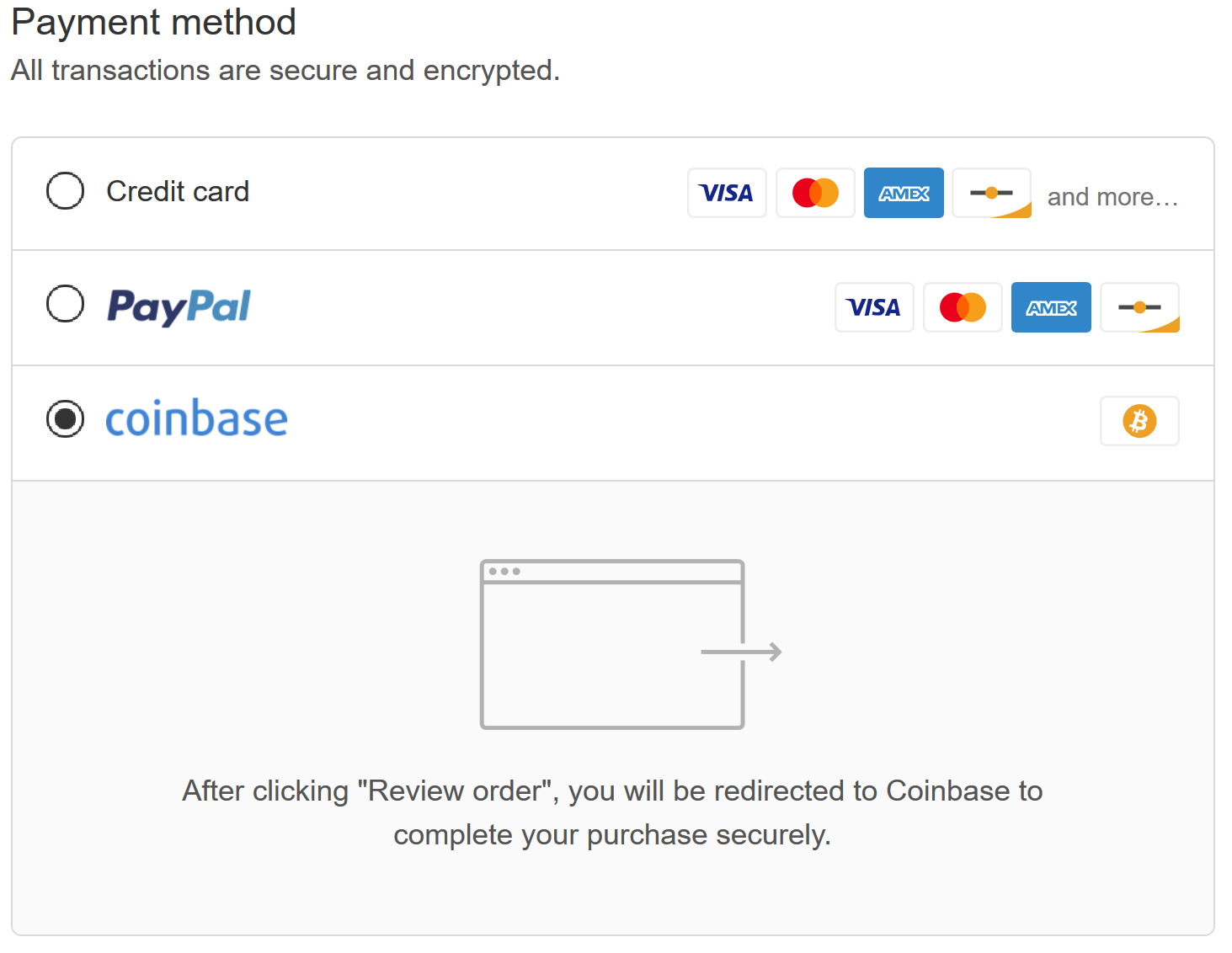

Ideas on how to Submit an application for Resource One Credit cards

Borrowers just who select one a no-interest introductory interest to the a charge card was a far greater cure for availability a credit line than simply a great HELOC can apply for one among them handmade cards from Funding One to web site. Potential borrowers could possibly get pre-recognized towards the Capital One webpages by typing some information about their finances. (This article does not result in a credit check that could connect with their credit score.)

When the a debtor try pre-accepted, Capital An individual’s website will then establish the fresh readily available charge card possibilities to them. Only if it choose one of them cards and determine to proceed to your app techniques often a credit score assessment just take put.

If someone else chooses to borrow secured on house collateral through getting a good cash-aside home mortgage refinance loan that have Financing Depot, one of Mortgage Depot’s financing officials manage book him or her through the refinancing techniques. Curious borrowers is also program to work well with that loan Depot financing administrator through the bank’s website.

Investment That Specialist and Individual Evaluations

Just like the Capital One has discontinued their home-mortgage company, the lending company will not are available in some of the house financing consumer-remark ratings one to Expenses assessed.

Since an even more general comparison of one’s providers, Financial support One received a get of just one.step 3 off 5 towards the TrustPilot. The higher Team Agency (BBB) collected a-1.thirteen from 5 average buyers comment score regarding Financing One to. The Bbb by itself offered Money You to a the- score, regardless if Financial support A person is maybe not licensed on Bbb.

Money One to Advantages

Financing A person’s most useful range-of-borrowing from the bank options are getting consumers with higher level credit whom only need to help you obtain for a short time. In this problem, Investment Your 0% basic price notes might be a less costly choice than just good HELOC.

The fresh 15-few days introductory several months might provide a borrower good ount of your time to get into the credit range and no focus cost. (For longer-name credit, even though, this one perform be more pricey.)

For those who need to borrow secured on house collateral that have good lay fees months, the only alternative offered due to Capital One could feel their referral program that have Loan Depot. Where situation, the brand new recommendation credit of up to $step 1,five-hundred with the closing costs you’ll depict a hefty offers. But not, just like the real mortgage conditions varies according to the problem, possible borrowers is to examine most of these conditions cautiously up against almost every other possibilities.

Money One to Cons

Family security financing is beyond your range out-of just what Money You’ve got picked provide. Regarding a huge-visualize viewpoint, its worth considering most other borrowing from the bank approaches. With respect to the state, it might churn out that a zero-focus basic speed bank card otherwise a money-away refinance mortgage compliment of Loan Depot is a better complement.

Yet not, if a debtor establishes that property guarantee mortgage or a good HELOC is the better service, then the simply method readily available would be to consider a different financial that give a far more compatible product range.

Possibilities to Resource One to

Listed below are some of selection so you can Investment One that you’ll bring appropriate borrowing options for somebody searching for a home security mortgage or a HELOC.