To store one thing swinging, promptly go back phone calls, messages and email. Pay attention to details whenever replying to advice and other demands.

Show patience but persistent.

Focus on the proper sense of necessity. Go ahead and follow through towards the class – real estate agent, bank, label company, inspector – to be certain everything is moving forward. Remember that each step takes time accomplish and you’re within the a queue of almost every other eager customers.

Get the dollars to each other.

In advance of closure, you’ll need good-sized cash to suit your down payment and you may closing costs. That need promoting financial investments. Do this far ahead of time to be sure the bucks is readily available, plus the financial will not lay a hold on tight it whenever you are waiting having funds to clear. You will additionally have to assemble files on the deals out of assets or other sources of closure financing.

Brand new USAA Guidance Cardiovascular system will bring general pointers, gadgets and you will tips to support your own journey. Everything consisted of is offered to own informational intentions simply and that is maybe not intended to depict one affirmation, indicated or required, because of the USAA otherwise one associates. Every suggestions considering was subject to alter without warning.

Able for another step?

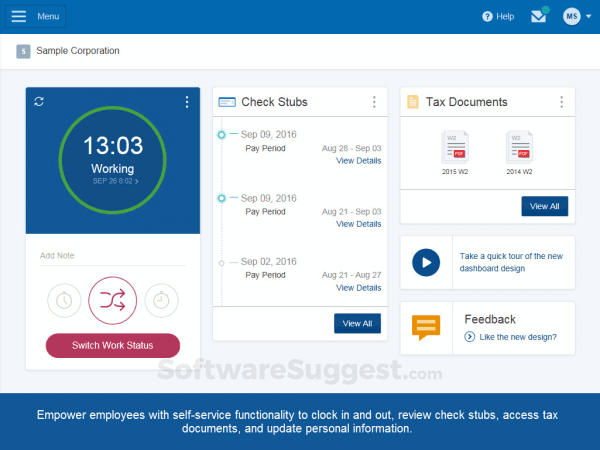

Since I look closer at that. we had asked within Observe out of Incompleteness letter a copy of your 2017 W-dos (whenever offered) and this i don’t discovered. New debtor told you of the bargain shedding apart until the end of NOI several months. Continue reading…